Congratulations on deciding to enroll in the The Inspira Health 403(b) or 401(k) plans!

Enroll in the plan

To enroll online, go to

LincolnFinancial.com

and follow the step-by-step instructions for enrolling in your plan.

Manage your account online

It's time to take charge of your retirement! Get started today by registering for online account access.

Learn more.

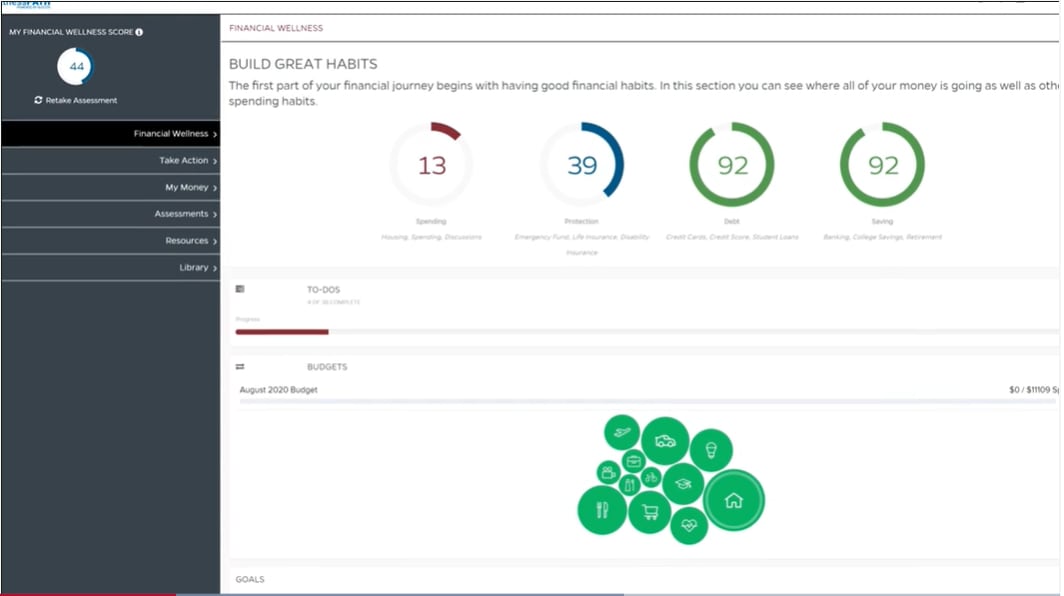

Lincoln WellnessPath®

Wellness isn’t just about physical health. There are emotional and financial components, too. Whether you want to save more or need to pay off debt, getting your finances in order can have an impact on your overall well-being. That’s where Lincoln can help. Lincoln WellnessPATH provides tools and personalized steps to manage your financial life. From creating a budget to building an emergency fund to paying down debt, our easy-to-use online tool helps you turn information into action so you can focus on both short- and long-term goals, such as saving for retirement. It’s easy to get started. Answer a few simple questions (such as, "Do you rent or have a mortgage?") and receive a financial wellness score that analyzes your saving, spending, debt, and protection.

Watch this short video for an overview on how you can improve your overall financial well-being so you can better prepare for retirement.

Log in to

LincolnFinancial.com/Retirement

and select Find Your Path on the account summary page. The first time you use the tool, you’ll take a short quiz to help you set goals, so you can immediately take action.

Get help with your account

- Update your contributions or set up automatic increases at LincolnFinancial.com. To change your savings rate, go to the Contributions tab and enter a new percentage, then click UPDATE. To set up automatic contribution increases, check the sign-up box, enter the percentage, frequency and start date, then click UPDATE.

- Reallocate your balance or update investment elections by logging onto your account at LincolnFinancial.com. Go to the Investments tab and click Change investments, then click the CHANGE INVESTMENTS button and follow the prompts. Click SUBMIT CHANGES to confirm your changes. If you've elected a model, it may automatically rebalance for you. Contact your Lincoln Financial representative if you have questions.

- Take a distribution. You may withdraw money from your account when you reach age 59½ or for a qualifying event as outlined in your enrollment kit.

- Please remember: Distributions from pretax accounts are subject to income tax upon withdrawal. Distributions from Roth accounts are tax-free, as long as certain criteria are met. Distributions from either pretax or Roth accounts taken before age 59 ½ may be subject to an additional 10% federal tax penalty. You should consult with a tax advisor before withdrawing any money from your account. Once you are ready to take a distribution, contact your Lincoln Financial retirement consultant for more information and assistance.