Introducing guaranteed income solutions to help participants secure income during retirement. Help them gain confidence by offering an option that provides dependable payments for life.

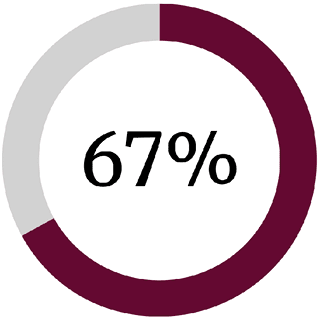

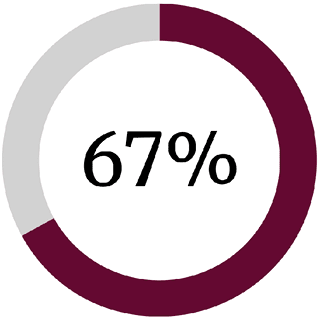

67% of employees

believe their employer has a responsibility to make sure employees are financially secure and well.1

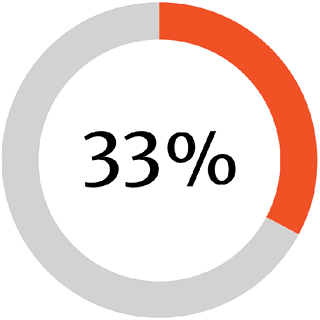

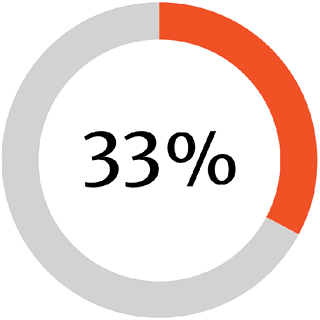

1/3 of employees

believe having investment options that provide a guaranteed lifetime income would be the most valuable improvement to their retirement plan.2

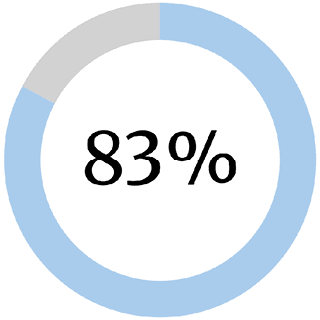

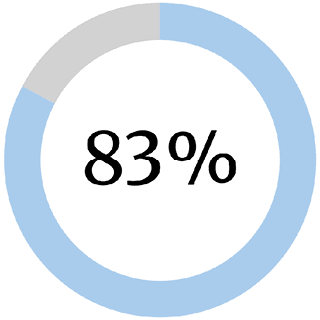

83% of employees

who are participating in a workplace retirement plan would be interested in using some or all of their retirement savings to purchase a product that guarantees monthly income.2

Answer a few simple questions to see which solution is right for your plan.

Lincoln PathBuilder Income® solutions create a foundation for security, providing guaranteed monthly income that continues for life. Receive guaranteed payments that won’t go down if the market drops, and may even go up. Use it as a standalone option or include it in the asset allocation of a custom target-date portfolio.

Income America™ 5forLife is a series of target-date portfolios that provide guaranteed lifetime income. The market may go up and down, but with Income America™ 5forLife, a lifetime income guarantee is built in — offering protection against market uncertainty during retirement.

These portfolios are collective investment funds for which Great Gray Trust Company, LLC is the trustee.

Compare investment structures, fees, guaranteed annual income rates, and more.

Contact your Lincoln representative to learn more or explore our website for details.

1 Employee Benefit Research Institute and Greenwald Research, 2022 – 2024 Workplace Wellness Surveys.

2 Employee Benefit Research Institute and Greenwald Research 2024 Retirement Confidence Survey.

Disclosures:

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. Amounts contributed to the annuity contract are invested in the LVIP American Global Balanced Allocation Managed Risk Fund, a fund of funds with a balanced allocation. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income.

THE LVIP AMERICAN GLOBAL BALANCED ALLOCATION MANAGED RISK FUND IS NOT GUARANTEED OR INSURED BY LINCOLN OR ANY OTHER INSURANCE COMPANY OR ENTITY, AND SHAREHOLDERS MAY EXPERIENCE LOSSES. THE STRATEGY USED BY THIS FUND IS SEPARATE AND DISTINCT FROM ANY ANNUITY OR INSURANCE CONTRACT RIDER OR FEATURES.

Lincoln PathBuilder Income® group variable annuity contracts (contract form AN-701 and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses. The annuity’s value fluctuates with the market value of the underlying investment option. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. For this and other additional information, please contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln PathBuilder Income® group contingent deferred annuity contract (contract form AN-745 and state variations) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. Limitations and exclusions may apply. May not be available in all states. Check with your Lincoln representative. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Investors are advised to consider carefully the investment objectives, risks, and expenses of the group annuity and its associated investment options before investing. For more information, contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

The Lincoln PathBuilder Income® powered by YourPath® is an optional Guaranteed Lifetime Withdrawal Benefit (GLWB) rider (form AR-678 and state variations) available in the Lincoln DirectorSM group variable annuity contract. Limitations and exclusions may apply. May not be available in all states.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Lincoln Financial is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations.

Income America

Important information: Guarantees are subject to the claims-paying ability of the issuing companies.

The market value of the account is never guaranteed and fluctuates based on investment performance. While participants can withdraw the market value of the account at any time without any fees or penalties, doing so will cause the participant to lose the income guarantee. The income base is never available for withdrawal but is only used for calculating income.

Each year on the participant’s birthday, their income base is compared to their current investment balance. If the investment balance is higher, the income base will be increased to match the investment balance. If the investment balance is lower, no adjustment will be made. Any resulting update to the guaranteed lifetime income payments will begin after the participant’s birthday and remain in effect for the following 12-month period. The step-up feature is available as long as assets remain in the investment.

A participant will be able to elect to receive income any time after age 65. If a participant elects the joint life option, the payout will be lower than 5%, depending on the age of the participant and the participant’s spouse when income is elected. If a participant withdraws more than the guaranteed annual income in any year, the income base and the future guaranteed annual income will decrease. However, in most scenarios, if a required minimum distribution exceeds the participant’s guaranteed income amount, the income base will not be affected, and the payments will not be lowered. Please contact your plan representative for more details.

If a participant is invested in the Income America 5ForLife target date portfolios, when they turn age 65 and at the time they elect to receive income, they must be invested in the 5ForLife In Retirement portfolio; investment exchanges will be automatically implemented from any other 5ForLife target date portfolio to the 5ForLife In Retirement portfolio. If a participant makes investment exchanges out of any 5ForLife portfolio, they may not make an investment exchange back into any 5ForLife portfolio within 90 calendar days.

Should participants change jobs or lose access to Income America 5ForLife, they may be able to roll over their 5ForLife balance to another retirement plan that offers Income America 5ForLife and retain the income guarantee, or to an IRA or plan that offers an option to retain the income benefit base and payout rate; however, the retirement plan or issuing insurer’s IRA solution may have different investments, fees, and other features.

The Income America Funds are Great Gray Trust Company, LLC Collective Investment Funds (“Great Gray Funds”) which are bank collective investment funds; they are not mutual funds. Great Gray Trust Company, LLC serves as the Trustee of the Great Gray Funds and maintains ultimate fiduciary authority over the management of, and investments made in, the Great Gray Funds. Great Gray Funds and their units are exempt from registration under the Investment Company Act of 1940 and the Securities Act of 1933, respectively.

Investments in the Great Gray Funds are not bank deposits or obligations of and are not insured or guaranteed by Great Gray Trust Company, LLC, any bank, the FDIC, the Federal Reserve, or any other governmental agency. The Great Gray Funds are commingled investment vehicles, and as such, the values of the underlying investments will rise and fall according to market activity; it is possible to lose money by investing in the Great Gray Funds.

Participation in Collective Investment Trust Funds is limited primarily to qualified retirement plans and certain state or local government plans and is not available to IRAs, non-governmental health and welfare plans and, in certain cases, Keogh (H.R. 10) plans. Collective Investment Trust Funds may be suitable investments for plan fiduciaries seeking to construct a well-diversified retirement savings program. Investors should consider the investment objectives, risks, charges, and expenses of any pooled investment company carefully before investing. The Additional Fund Information and Principal Risk Definitions (PRD) contains this and other information about a Collective Investment Trust Fund and is available at www.greatgray.com/principalriskdefinitions or ask for a free of charge copy by contacting Great Gray Trust Company, LLC at (866) 427-6885.

Great Gray® and Great Gray Trust Company are service marks used in connection with various fiduciary and non-fiduciary services offered by Great Gray Trust Company, LLC.

The Trustee has appointed American Century Investment Management, Inc. as Glidepath Manager to the Income America Funds to assist it in connection with providing strategic asset allocations for each of the vintages of the Income America Funds. American Century Investments® provides underlying sub-asset class management and target date glide path management (when applicable) as well as marketing support for Income America.

The Trustee has appointed Wilshire Advisors LLC (“Wilshire”) as Sub-Advisor to the Income America Funds to assist it in connection with the investment of assets in the Income America Funds. Wilshire serves as the Investment advisor fiduciary under ERISA 3(21) and is responsible for recommending glide path manager, guaranteed lifetime withdrawal benefit providers, underlying fund products and stable value offerings to the trustee from an investment universe selected by the product consultant for each category.

SS&C provides the Retirement Income Clearing and Calculation Platform (RICC), a middleware application designed to facilitate the efficient distribution and servicing of in-plan guaranteed income products across various recordkeepers and participating insurers. The SS&C RICC platform also calculates and maintains the participant guaranteed lifetime withdrawal benefit values for Income America 5ForLife.

This material is not a recommendation to buy, sell, hold or roll over any asset; adopt an investment strategy; retain a specific investment manager; or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should discuss their specific situation with their financial professional. Diversification does not assure a profit, nor does it protect against loss of principal.

The Income America 5ForLife funds include a group annuity contract, which provides a plan participant with guaranteed annual retirement income that is supported by a contract between the trustee and the following issuing insurance companies:

Each fund in the series may invest in a fixed annuity contract issued by Nationwide Life Insurance Company and The Lincoln National Life Insurance Company. This fixed annuity contract is separate from the group annuity contracts issued by the same entities which support the guaranteed annual retirement income.

All contractual guarantees, including those for guaranteed income, are funded from the issuing insurance companies’ general accounts and are subject to the claims-paying ability of the issuing insurance company. Neither issuing insurance company is a trustee for any assets held in any of the collective investment funds.

The issuing insurance companies and their affiliates, distributors, respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult your own tax or legal advisor for answers to your specific questions.

For more information, please contact your employer or your retirement plan.

All entities listed within this document are separate and nonaffiliated companies.

These investment options may not be available in all states.

The third-party marks and logos listed are the intellectual property of each respective entity and its affiliates.

©2025 Income America, LLC

Not all retirement products mentioned are approved at all broker-dealers.

Privacy | Legal | ©2026 Lincoln National Corporation

1/26 Z10

Order code: DC-IPG-IDE001

LCN-8023886-053025

Introducing guaranteed income solutions to help participants secure income during retirement. Help them gain confidence by offering an option that provides dependable payments for life.

67% of employees

believe their employer has a responsibility to make sure employees are financially secure and well.1

1/3 of employees

believe having investment options that provide a guaranteed lifetime income would be the most valuable improvement to their retirement plan.2

83% of employees

who are participating in a workplace retirement plan would be interested in using some or all of their retirement savings to purchase a product that guarantees monthly income.2

Answer a few simple questions to see which solution is right for your plan.

Lincoln PathBuilder Income® solutions create a foundation for security, providing guaranteed monthly income that continues for life. Receive guaranteed payments that won’t go down if the market drops, and may even go up. Use it as a standalone option or include it in the asset allocation of a custom target-date portfolio.

Income America™ 5forLife is a series of target-date portfolios that provide guaranteed lifetime income. The market may go up and down, but with Income America™ 5forLife, a lifetime income guarantee is built in — offering protection against market uncertainty during retirement.

These portfolios are collective investment funds for which Great Gray Trust Company, LLC is the trustee.

Compare investment structures, fees, guaranteed annual income rates, and more.

Contact your Lincoln representative to learn more or explore our website for details.

Disclosures:

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. Amounts contributed to the annuity contract are invested in the LVIP American Global Balanced Allocation Managed Risk Fund, a fund of funds with a balanced allocation. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income.

THE LVIP AMERICAN GLOBAL BALANCED ALLOCATION MANAGED RISK FUND IS NOT GUARANTEED OR INSURED BY LINCOLN OR ANY OTHER INSURANCE COMPANY OR ENTITY, AND SHAREHOLDERS MAY EXPERIENCE LOSSES. THE STRATEGY USED BY THIS FUND IS SEPARATE AND DISTINCT FROM ANY ANNUITY OR INSURANCE CONTRACT RIDER OR FEATURES.

Lincoln PathBuilder Income® group variable annuity contracts (contract form AN-701 and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses. The annuity’s value fluctuates with the market value of the underlying investment option. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. For this and other additional information, please contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln PathBuilder Income® group contingent deferred annuity contract (contract form AN-745 and state variations) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. Limitations and exclusions may apply. May not be available in all states. Check with your Lincoln representative. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Investors are advised to consider carefully the investment objectives, risks, and expenses of the group annuity and its associated investment options before investing. For more information, contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

The Lincoln PathBuilder Income® powered by YourPath® is an optional Guaranteed Lifetime Withdrawal Benefit (GLWB) rider (form AR-678 and state variations) available in the Lincoln DirectorSM group variable annuity contract. Limitations and exclusions may apply. May not be available in all states.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Lincoln Financial is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations.

Income America

Important information: Guarantees are subject to the claims-paying ability of the issuing companies.

The market value of the account is never guaranteed and fluctuates based on investment performance. While participants can withdraw the market value of the account at any time without any fees or penalties, doing so will cause the participant to lose the income guarantee. The income base is never available for withdrawal but is only used for calculating income.

Each year on the participant’s birthday, their income base is compared to their current investment balance. If the investment balance is higher, the income base will be increased to match the investment balance. If the investment balance is lower, no adjustment will be made. Any resulting update to the guaranteed lifetime income payments will begin after the participant’s birthday and remain in effect for the following 12-month period. The step-up feature is available as long as assets remain in the investment.

A participant will be able to elect to receive income any time after age 65. If a participant elects the joint life option, the payout will be lower than 5%, depending on the age of the participant and the participant’s spouse when income is elected. If a participant withdraws more than the guaranteed annual income in any year, the income base and the future guaranteed annual income will decrease. However, in most scenarios, if a required minimum distribution exceeds the participant’s guaranteed income amount, the income base will not be affected, and the payments will not be lowered. Please contact your plan representative for more details.

If a participant is invested in the Income America 5ForLife target date portfolios, when they turn age 65 and at the time they elect to receive income, they must be invested in the 5ForLife In Retirement portfolio; investment exchanges will be automatically implemented from any other 5ForLife target date portfolio to the 5ForLife In Retirement portfolio. If a participant makes investment exchanges out of any 5ForLife portfolio, they may not make an investment exchange back into any 5ForLife portfolio within 90 calendar days.

Should participants change jobs or lose access to Income America 5ForLife, they may be able to roll over their 5ForLife balance to another retirement plan that offers Income America 5ForLife and retain the income guarantee, or to an IRA or plan that offers an option to retain the income benefit base and payout rate; however, the retirement plan or issuing insurer’s IRA solution may have different investments, fees, and other features.

The Income America Funds are Great Gray Trust Company, LLC Collective Investment Funds (“Great Gray Funds”) which are bank collective investment funds; they are not mutual funds. Great Gray Trust Company, LLC serves as the Trustee of the Great Gray Funds and maintains ultimate fiduciary authority over the management of, and investments made in, the Great Gray Funds. Great Gray Funds and their units are exempt from registration under the Investment Company Act of 1940 and the Securities Act of 1933, respectively.

Investments in the Great Gray Funds are not bank deposits or obligations of and are not insured or guaranteed by Great Gray Trust Company, LLC, any bank, the FDIC, the Federal Reserve, or any other governmental agency. The Great Gray Funds are commingled investment vehicles, and as such, the values of the underlying investments will rise and fall according to market activity; it is possible to lose money by investing in the Great Gray Funds.

Participation in Collective Investment Trust Funds is limited primarily to qualified retirement plans and certain state or local government plans and is not available to IRAs, non-governmental health and welfare plans and, in certain cases, Keogh (H.R. 10) plans. Collective Investment Trust Funds may be suitable investments for plan fiduciaries seeking to construct a well-diversified retirement savings program. Investors should consider the investment objectives, risks, charges, and expenses of any pooled investment company carefully before investing. The Additional Fund Information and Principal Risk Definitions (PRD) contains this and other information about a Collective Investment Trust Fund and is available at www.greatgray.com/principalriskdefinitions or ask for a free of charge copy by contacting Great Gray Trust Company, LLC at (866) 427-6885.

Great Gray® and Great Gray Trust Company are service marks used in connection with various fiduciary and non-fiduciary services offered by Great Gray Trust Company, LLC.

The Trustee has appointed American Century Investment Management, Inc. as Glidepath Manager to the Income America Funds to assist it in connection with providing strategic asset allocations for each of the vintages of the Income America Funds. American Century Investments® provides underlying sub-asset class management and target date glide path management (when applicable) as well as marketing support for Income America.

The Trustee has appointed Wilshire Advisors LLC (“Wilshire”) as Sub-Advisor to the Income America Funds to assist it in connection with the investment of assets in the Income America Funds. Wilshire serves as the Investment advisor fiduciary under ERISA 3(21) and is responsible for recommending glide path manager, guaranteed lifetime withdrawal benefit providers, underlying fund products and stable value offerings to the trustee from an investment universe selected by the product consultant for each category.

SS&C provides the Retirement Income Clearing and Calculation Platform (RICC), a middleware application designed to facilitate the efficient distribution and servicing of in-plan guaranteed income products across various recordkeepers and participating insurers. The SS&C RICC platform also calculates and maintains the participant guaranteed lifetime withdrawal benefit values for Income America 5ForLife.

This material is not a recommendation to buy, sell, hold or roll over any asset; adopt an investment strategy; retain a specific investment manager; or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should discuss their specific situation with their financial professional. Diversification does not assure a profit, nor does it protect against loss of principal.

The Income America 5ForLife funds include a group annuity contract, which provides a plan participant with guaranteed annual retirement income that is supported by a contract between the trustee and the following issuing insurance companies:

Each fund in the series may invest in a fixed annuity contract issued by Nationwide Life Insurance Company and The Lincoln National Life Insurance Company. This fixed annuity contract is separate from the group annuity contracts issued by the same entities which support the guaranteed annual retirement income.

All contractual guarantees, including those for guaranteed income, are funded from the issuing insurance companies’ general accounts and are subject to the claims-paying ability of the issuing insurance company. Neither issuing insurance company is a trustee for any assets held in any of the collective investment funds.

The issuing insurance companies and their affiliates, distributors, respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult your own tax or legal advisor for answers to your specific questions.

For more information, please contact your employer or your retirement plan.

All entities listed within this document are separate and nonaffiliated companies.

These investment options may not be available in all states.

The third-party marks and logos listed are the intellectual property of each respective entity and its affiliates.

©2025 Income America, LLC

Not all retirement products mentioned are approved at all broker-dealers.

Privacy | Legal | ©2026 Lincoln National Corporation

1/26 Z10

Order code: DC-IPG-IDE001

LCN-8023886-053025

1 Employee Benefit Research Institute and Greenwald Research, 2022 – 2024 Workplace Wellness Surveys.

2 Employee Benefit Research Institute and Greenwald Research 2024 Retirement Confidence Survey.

Introducing guaranteed income solutions to help participants secure income during retirement. Help them gain confidence by offering an option that provides dependable payments for life.

67% of employees

believe their employer has a responsibility to make sure employees are financially secure and well.1

1/3 of employees

believe having investment options that provide a guaranteed lifetime income would be the most valuable improvement to their retirement plan.2

83% of employees

who are participating in a workplace retirement plan would be interested in using some or all of their retirement savings to purchase a product that guarantees monthly income.2

Answer a few simple questions to see which solution is right for your plan.

Lincoln PathBuilder Income® solutions create a foundation for security, providing guaranteed monthly income that continues for life. Receive guaranteed payments that won’t go down if the market drops, and may even go up. Use it as a standalone option or include it in the asset allocation of a custom target-date portfolio.

Income America™ 5forLife is a series of target-date portfolios that provide guaranteed lifetime income. The market may go up and down, but with Income America™ 5forLife, a lifetime income guarantee is built in — offering protection against market uncertainty during retirement.

These portfolios are collective investment funds for which Great Gray Trust Company, LLC is the trustee.

Compare investment structures, fees, guaranteed annual income rates, and more.

Contact your Lincoln representative to learn more or explore our website for details.

1 Employee Benefit Research Institute and Greenwald Research, 2022 – 2024 Workplace Wellness Surveys.

2 Employee Benefit Research Institute and Greenwald Research 2024 Retirement Confidence Survey.

Disclosures:

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. Amounts contributed to the annuity contract are invested in the LVIP American Global Balanced Allocation Managed Risk Fund, a fund of funds with a balanced allocation. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income.

THE LVIP AMERICAN GLOBAL BALANCED ALLOCATION MANAGED RISK FUND IS NOT GUARANTEED OR INSURED BY LINCOLN OR ANY OTHER INSURANCE COMPANY OR ENTITY, AND SHAREHOLDERS MAY EXPERIENCE LOSSES. THE STRATEGY USED BY THIS FUND IS SEPARATE AND DISTINCT FROM ANY ANNUITY OR INSURANCE CONTRACT RIDER OR FEATURES.

Lincoln PathBuilder Income® group variable annuity contracts (contract form AN-701 and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses. The annuity’s value fluctuates with the market value of the underlying investment option. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. For this and other additional information, please contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln PathBuilder Income® group contingent deferred annuity contract (contract form AN-745 and state variations) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. Limitations and exclusions may apply. May not be available in all states. Check with your Lincoln representative. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Investors are advised to consider carefully the investment objectives, risks, and expenses of the group annuity and its associated investment options before investing. For more information, contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

The Lincoln PathBuilder Income® powered by YourPath® is an optional Guaranteed Lifetime Withdrawal Benefit (GLWB) rider (form AR-678 and state variations) available in the Lincoln DirectorSM group variable annuity contract. Limitations and exclusions may apply. May not be available in all states.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Lincoln Financial is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations.

Income America

Important information: Guarantees are subject to the claims-paying ability of the issuing companies.

The market value of the account is never guaranteed and fluctuates based on investment performance. While participants can withdraw the market value of the account at any time without any fees or penalties, doing so will cause the participant to lose the income guarantee. The income base is never available for withdrawal but is only used for calculating income.

Each year on the participant’s birthday, their income base is compared to their current investment balance. If the investment balance is higher, the income base will be increased to match the investment balance. If the investment balance is lower, no adjustment will be made. Any resulting update to the guaranteed lifetime income payments will begin after the participant’s birthday and remain in effect for the following 12-month period. The step-up feature is available as long as assets remain in the investment.

A participant will be able to elect to receive income any time after age 65. If a participant elects the joint life option, the payout will be lower than 5%, depending on the age of the participant and the participant’s spouse when income is elected. If a participant withdraws more than the guaranteed annual income in any year, the income base and the future guaranteed annual income will decrease. However, in most scenarios, if a required minimum distribution exceeds the participant’s guaranteed income amount, the income base will not be affected, and the payments will not be lowered. Please contact your plan representative for more details.

If a participant is invested in the Income America 5ForLife target date portfolios, when they turn age 65 and at the time they elect to receive income, they must be invested in the 5ForLife In Retirement portfolio; investment exchanges will be automatically implemented from any other 5ForLife target date portfolio to the 5ForLife In Retirement portfolio. If a participant makes investment exchanges out of any 5ForLife portfolio, they may not make an investment exchange back into any 5ForLife portfolio within 90 calendar days.

Should participants change jobs or lose access to Income America 5ForLife, they may be able to roll over their 5ForLife balance to another retirement plan that offers Income America 5ForLife and retain the income guarantee, or to an IRA or plan that offers an option to retain the income benefit base and payout rate; however, the retirement plan or issuing insurer’s IRA solution may have different investments, fees, and other features.

The Income America Funds are Great Gray Trust Company, LLC Collective Investment Funds (“Great Gray Funds”) which are bank collective investment funds; they are not mutual funds. Great Gray Trust Company, LLC serves as the Trustee of the Great Gray Funds and maintains ultimate fiduciary authority over the management of, and investments made in, the Great Gray Funds. Great Gray Funds and their units are exempt from registration under the Investment Company Act of 1940 and the Securities Act of 1933, respectively.

Investments in the Great Gray Funds are not bank deposits or obligations of and are not insured or guaranteed by Great Gray Trust Company, LLC, any bank, the FDIC, the Federal Reserve, or any other governmental agency. The Great Gray Funds are commingled investment vehicles, and as such, the values of the underlying investments will rise and fall according to market activity; it is possible to lose money by investing in the Great Gray Funds.

Participation in Collective Investment Trust Funds is limited primarily to qualified retirement plans and certain state or local government plans and is not available to IRAs, non-governmental health and welfare plans and, in certain cases, Keogh (H.R. 10) plans. Collective Investment Trust Funds may be suitable investments for plan fiduciaries seeking to construct a well-diversified retirement savings program. Investors should consider the investment objectives, risks, charges, and expenses of any pooled investment company carefully before investing. The Additional Fund Information and Principal Risk Definitions (PRD) contains this and other information about a Collective Investment Trust Fund and is available at www.greatgray.com/principalriskdefinitions or ask for a free of charge copy by contacting Great Gray Trust Company, LLC at (866) 427-6885.

Great Gray® and Great Gray Trust Company are service marks used in connection with various fiduciary and non-fiduciary services offered by Great Gray Trust Company, LLC.

The Trustee has appointed American Century Investment Management, Inc. as Glidepath Manager to the Income America Funds to assist it in connection with providing strategic asset allocations for each of the vintages of the Income America Funds. American Century Investments® provides underlying sub-asset class management and target date glide path management (when applicable) as well as marketing support for Income America.

The Trustee has appointed Wilshire Advisors LLC (“Wilshire”) as Sub-Advisor to the Income America Funds to assist it in connection with the investment of assets in the Income America Funds. Wilshire serves as the Investment advisor fiduciary under ERISA 3(21) and is responsible for recommending glide path manager, guaranteed lifetime withdrawal benefit providers, underlying fund products and stable value offerings to the trustee from an investment universe selected by the product consultant for each category.

SS&C provides the Retirement Income Clearing and Calculation Platform (RICC), a middleware application designed to facilitate the efficient distribution and servicing of in-plan guaranteed income products across various recordkeepers and participating insurers. The SS&C RICC platform also calculates and maintains the participant guaranteed lifetime withdrawal benefit values for Income America 5ForLife.

This material is not a recommendation to buy, sell, hold or roll over any asset; adopt an investment strategy; retain a specific investment manager; or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should discuss their specific situation with their financial professional. Diversification does not assure a profit, nor does it protect against loss of principal.

The Income America 5ForLife funds include a group annuity contract, which provides a plan participant with guaranteed annual retirement income that is supported by a contract between the trustee and the following issuing insurance companies.

Each fund in the series may invest in a fixed annuity contract issued by Nationwide Life Insurance Company and The Lincoln National Life Insurance Company. This fixed annuity contract is separate from the group annuity contracts issued by the same entities which support the guaranteed annual retirement income.

All contractual guarantees, including those for guaranteed income, are funded from the issuing insurance companies’ general accounts and are subject to the claims-paying ability of the issuing insurance company. Neither issuing insurance company is a trustee for any assets held in any of the collective investment funds.

The issuing insurance companies and their affiliates, distributors, respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult your own tax or legal advisor for answers to your specific questions.

For more information, please contact your employer or your retirement plan.

All entities listed within this document are separate and nonaffiliated companies.

These investment options may not be available in all states.

The third-party marks and logos listed are the intellectual property of each respective entity and its affiliates.

©2025 Income America, LLC

Not all retirement products mentioned are approved at all broker-dealers.

Privacy | Legal | ©2026 Lincoln National Corporation

1/26 Z10

Order code: DC-IPG-IDE001

LCN-8023886-053025

Introducing guaranteed income solutions to help participants secure income during retirement. Help them gain confidence by offering an option that provides dependable payments for life.

67% of employees

believe their employer has a responsibility to make sure employees are financially secure and well.1

1/3 of employees

believe having investment options that provide a guaranteed lifetime income would be the most valuable improvement to their retirement plan.2

83% of employees

who are participating in a workplace retirement plan would be interested in using some or all of their retirement savings to purchase a product that guarantees monthly income.2

Answer a few simple questions to see which solution is right for your plan.

Lincoln PathBuilder Income® solutions create a foundation for security, providing guaranteed monthly income that continues for life. Receive guaranteed payments that won’t go down if the market drops, and may even go up. Use it as a standalone option or include it in the asset allocation of a custom target-date portfolio.

Income America™ 5forLife is a series of target-date portfolios that provide guaranteed lifetime income. The market may go up and down, but with Income America™ 5forLife, a lifetime income guarantee is built in — offering protection against market uncertainty during retirement.

These portfolios are collective investment funds for which Great Gray Trust Company, LLC is the trustee.

Compare investment structures, fees, guaranteed annual income rates, and more.

Contact your Lincoln representative to learn more or explore our website for details.

1 Employee Benefit Research Institute and Greenwald Research, 2022 – 2024 Workplace Wellness Surveys.

2 Employee Benefit Research Institute and Greenwald Research 2024 Retirement Confidence Survey.

Disclosures:

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. Amounts contributed to the annuity contract are invested in the LVIP American Global Balanced Allocation Managed Risk Fund, a fund of funds with a balanced allocation. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income.

THE LVIP AMERICAN GLOBAL BALANCED ALLOCATION MANAGED RISK FUND IS NOT GUARANTEED OR INSURED BY LINCOLN OR ANY OTHER INSURANCE COMPANY OR ENTITY, AND SHAREHOLDERS MAY EXPERIENCE LOSSES. THE STRATEGY USED BY THIS FUND IS SEPARATE AND DISTINCT FROM ANY ANNUITY OR INSURANCE CONTRACT RIDER OR FEATURES.

Lincoln PathBuilder Income® group variable annuity contracts (contract form AN-701 and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses. The annuity’s value fluctuates with the market value of the underlying investment option. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. For this and other additional information, please contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln PathBuilder Income® group contingent deferred annuity contract (contract form AN-745 and state variations) is issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. Limitations and exclusions may apply. May not be available in all states. Check with your Lincoln representative. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Investors are advised to consider carefully the investment objectives, risks, and expenses of the group annuity and its associated investment options before investing. For more information, contact Lincoln Financial. Please read this information carefully before investing or sending money. Products and features are subject to state availability.

The Lincoln PathBuilder Income® powered by YourPath® is an optional Guaranteed Lifetime Withdrawal Benefit (GLWB) rider (form AR-678 and state variations) available in the Lincoln DirectorSM group variable annuity contract. Limitations and exclusions may apply. May not be available in all states.

Lincoln PathBuilder Income® solutions are offered as a group annuity. The guarantee is provided by a contract with The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency this annuity is purchased from or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain insurance components and have fees and expenses. The group annuity is paired with an investment option that fluctuates with the market value. Withdrawals from your retirement plan may carry tax consequences, including possible tax penalties.

Lincoln Financial is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations.

Income America

Important information: Guarantees are subject to the claims-paying ability of the issuing companies.

The market value of the account is never guaranteed and fluctuates based on investment performance. While participants can withdraw the market value of the account at any time without any fees or penalties, doing so will cause the participant to lose the income guarantee. The income base is never available for withdrawal but is only used for calculating income.

Each year on the participant’s birthday, their income base is compared to their current investment balance. If the investment balance is higher, the income base will be increased to match the investment balance. If the investment balance is lower, no adjustment will be made. Any resulting update to the guaranteed lifetime income payments will begin after the participant’s birthday and remain in effect for the following 12-month period. The step-up feature is available as long as assets remain in the investment.

A participant will be able to elect to receive income any time after age 65. If a participant elects the joint life option, the payout will be lower than 5%, depending on the age of the participant and the participant’s spouse when income is elected. If a participant withdraws more than the guaranteed annual income in any year, the income base and the future guaranteed annual income will decrease. However, in most scenarios, if a required minimum distribution exceeds the participant’s guaranteed income amount, the income base will not be affected, and the payments will not be lowered. Please contact your plan representative for more details.

If a participant is invested in the Income America 5ForLife target date portfolios, when they turn age 65 and at the time they elect to receive income, they must be invested in the 5ForLife In Retirement portfolio; investment exchanges will be automatically implemented from any other 5ForLife target date portfolio to the 5ForLife In Retirement portfolio. If a participant makes investment exchanges out of any 5ForLife portfolio, they may not make an investment exchange back into any 5ForLife portfolio within 90 calendar days.

Should participants change jobs or lose access to Income America 5ForLife, they may be able to roll over their 5ForLife balance to another retirement plan that offers Income America 5ForLife and retain the income guarantee, or to an IRA or plan that offers an option to retain the income benefit base and payout rate; however, the retirement plan or issuing insurer’s IRA solution may have different investments, fees, and other features.

The Income America Funds are Great Gray Trust Company, LLC Collective Investment Funds (“Great Gray Funds”) which are bank collective investment funds; they are not mutual funds. Great Gray Trust Company, LLC serves as the Trustee of the Great Gray Funds and maintains ultimate fiduciary authority over the management of, and investments made in, the Great Gray Funds. Great Gray Funds and their units are exempt from registration under the Investment Company Act of 1940 and the Securities Act of 1933, respectively.

Investments in the Great Gray Funds are not bank deposits or obligations of and are not insured or guaranteed by Great Gray Trust Company, LLC, any bank, the FDIC, the Federal Reserve, or any other governmental agency. The Great Gray Funds are commingled investment vehicles, and as such, the values of the underlying investments will rise and fall according to market activity; it is possible to lose money by investing in the Great Gray Funds.

Participation in Collective Investment Trust Funds is limited primarily to qualified retirement plans and certain state or local government plans and is not available to IRAs, non-governmental health and welfare plans and, in certain cases, Keogh (H.R. 10) plans. Collective Investment Trust Funds may be suitable investments for plan fiduciaries seeking to construct a well-diversified retirement savings program. Investors should consider the investment objectives, risks, charges, and expenses of any pooled investment company carefully before investing. The Additional Fund Information and Principal Risk Definitions (PRD) contains this and other information about a Collective Investment Trust Fund and is available at www.greatgray.com/principalriskdefinitions or ask for a free of charge copy by contacting Great Gray Trust Company, LLC at (866) 427-6885.

Great Gray® and Great Gray Trust Company are service marks used in connection with various fiduciary and non-fiduciary services offered by Great Gray Trust Company, LLC.

The Trustee has appointed American Century Investment Management, Inc. as Glidepath Manager to the Income America Funds to assist it in connection with providing strategic asset allocations for each of the vintages of the Income America Funds. American Century Investments® provides underlying sub-asset class management and target date glide path management (when applicable) as well as marketing support for Income America.

The Trustee has appointed Wilshire Advisors LLC (“Wilshire”) as Sub-Advisor to the Income America Funds to assist it in connection with the investment of assets in the Income America Funds. Wilshire serves as the Investment advisor fiduciary under ERISA 3(21) and is responsible for recommending glide path manager, guaranteed lifetime withdrawal benefit providers, underlying fund products and stable value offerings to the trustee from an investment universe selected by the product consultant for each category.

SS&C provides the Retirement Income Clearing and Calculation Platform (RICC), a middleware application designed to facilitate the efficient distribution and servicing of in-plan guaranteed income products across various recordkeepers and participating insurers. The SS&C RICC platform also calculates and maintains the participant guaranteed lifetime withdrawal benefit values for Income America 5ForLife.

This material is not a recommendation to buy, sell, hold or roll over any asset; adopt an investment strategy; retain a specific investment manager; or use a particular account type. It does not take into account the specific investment objectives, tax and financial condition, or particular needs of any specific person. Investors should discuss their specific situation with their financial professional. Diversification does not assure a profit, nor does it protect against loss of principal.

The Income America 5ForLife funds include a group annuity contract, which provides a plan participant with guaranteed annual retirement income that is supported by a contract between the trustee and the following issuing insurance companies:

Each fund in the series may invest in a fixed annuity contract issued by Nationwide Life Insurance Company and The Lincoln National Life Insurance Company. This fixed annuity contract is separate from the group annuity contracts issued by the same entities which support the guaranteed annual retirement income.

All contractual guarantees, including those for guaranteed income, are funded from the issuing insurance companies’ general accounts and are subject to the claims-paying ability of the issuing insurance company. Neither issuing insurance company is a trustee for any assets held in any of the collective investment funds.

The issuing insurance companies and their affiliates, distributors, respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult your own tax or legal advisor for answers to your specific questions.

For more information, please contact your employer or your retirement plan.

All entities listed within this document are separate and nonaffiliated companies.

These investment options may not be available in all states.

The third-party marks and logos listed are the intellectual property of each respective entity and its affiliates.

©2025 Income America, LLC

Not all retirement products mentioned are approved at all broker-dealers.

Privacy | Legal | ©2026 Lincoln National Corporation

1/26 Z10

Order code: DC-IPG-IDE001

LCN-8023886-053025