Important information and index disclosures

Important information and index disclosures

Purpose

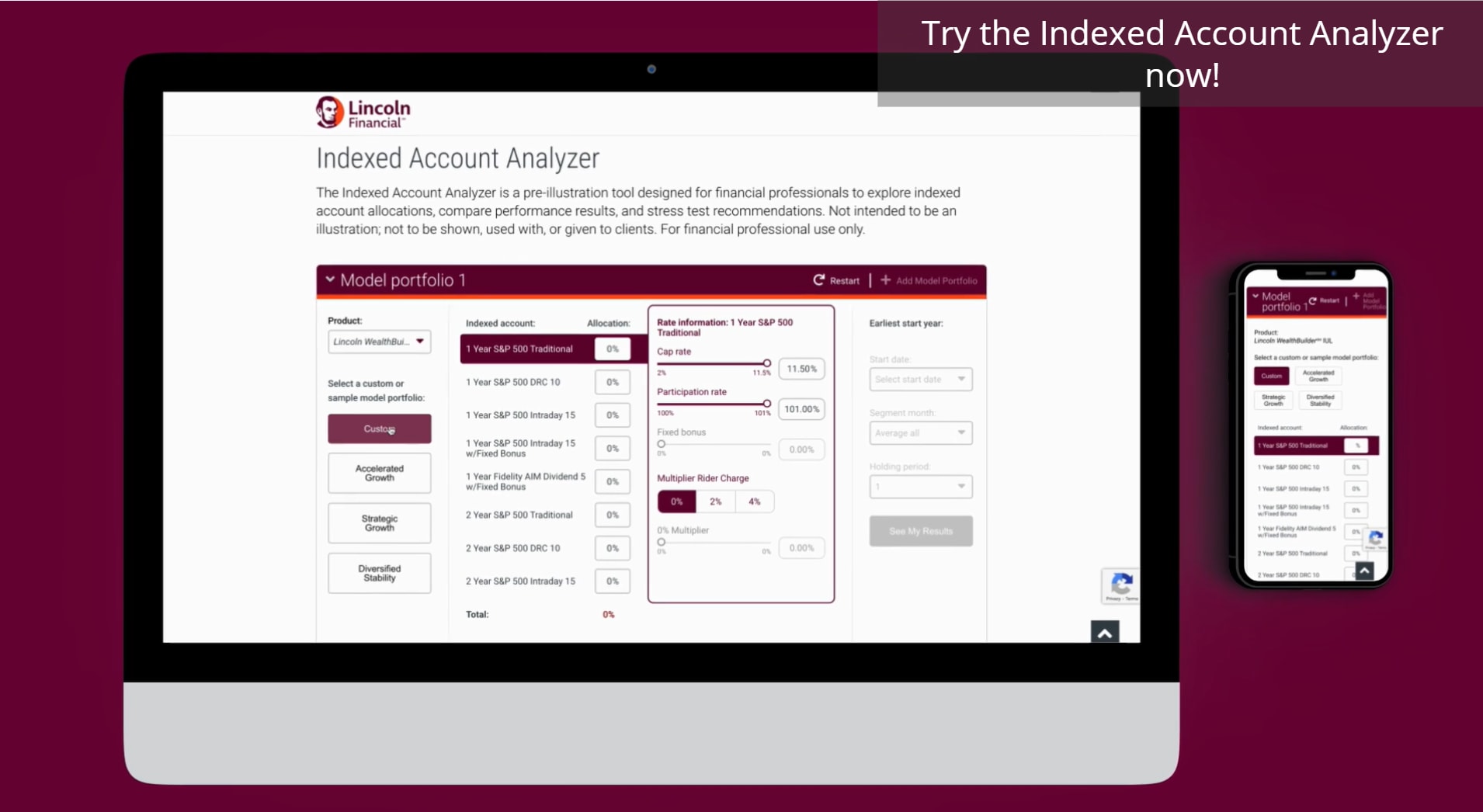

This analyzer is designed to help you better understand how the different accounts, cap rates, participation rates, multiplier rates and associated charges affect the potential credits in indexed universal life insurance policies. By varying the percentage allocation of total assets in each account, the participation features (accounts, growth caps, and participation rates) or by varying the calendar years presented you can see how aggregated growth rates would vary based on the performance of underlying indexes. The rates of return shown here are hypothetical and not representative of any indexed universal life insurance policy, as they do not consider the effects of insurance policy charges. Please provide a personalized basic life insurance illustration to your client.

Historical returns are no guarantee of future performance. The returns shown are not representative of an indexed life insurance product.

Underlying Index Disclosures

The S&P 500® Index, S&P 500® Dynamic Intraday TCA Index, and S&P 500® Daily Risk Control 10% Index (“Indexes”) and associated data are a product of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Lincoln Financial, 2024 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Neither S&P Dow Jones Indices LLC, SPFS, Dow Jones, their affiliates nor their licensors (“S&P DJI”) make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and S&P DJI shall have no liability for any errors, omissions, or interruptions of any index or the data included therein.

The S&P 500® Index is a price index and does not reflect dividends paid on the underlying stock. It is not possible to invest directly in an index.

The S&P 500® Dynamic Intraday TCA Index methodology was created based on historical data of the Index components. The methodology is available at: https://www.spglobal.com/spdji/en/indices/multi-asset/sp-500-dynamic-intraday-tca-index-usd-er/#overview

The S&P 500® Daily Risk Control 10% Index methodology was created based on historical data of the Index components. The methodology is available at: https://www.spglobal.com/spdji/en/indices/multi-asset/sp-500-daily-risk-control-10-index/?currency=USD&returntype=E-#overview

The Fidelity AIM® Dividend Index (the “Index”) is a product of Fidelity Product Services LLC (“FPS”) and has been licensed for use by The Lincoln National Life Insurance Company and its affiliates and reinsurers (“Lincoln”). Fidelity is a registered trademark of FMR LLC. The Index is the exclusive property of FPS and is made and compiled without regard to the needs, including, but not limited to, the suitability needs of Lincoln or any Lincoln life insurance owner. Lincoln exercises sole discretion in determining whether and how the life insurance will be linked to the value of the Index. FPS does not provide investment advice to owners of the life insurance, and in no event shall any Lincoln life insurance policy owner be deemed to be a client of FPS. Neither FPS nor any third party involved in, or related to, making or compiling the Index makes any representation regarding the Index, Index information, Index or market performance, life insurance generally or the Lincoln life insurance in particular, and Lincoln life insurance is not sold, sponsored, endorsed or promoted by FPS or any other third party involved in, or related to, making or compiling the Index (including the Index calculation agent, as applicable). FPS disclaims all warranties, express or implied, including all warranties of merchantability or fitness for a particular use; does not guarantee the adequacy, accuracy, timeliness, and/or completeness of the Index or any data or communication related thereto; and assumes no liability for errors, omissions, or interruptions of the Fidelity AIM® Dividend Index.

The Fidelity AIM® Dividend Index (FIDAIMDN) was created in 2019 for Lincoln. The Index methodology was created based on historical data of the Index components. The methodology is available at: https://institutional.fidelity.com/app/literature/doc/9896896/fidelity-aim-dividend-index-methodology.html

Backtesting Notice

Index data used in this analyzer includes hypothetical back-tested performance. The Launch Date of the S&P 500® Dynamic Intraday TCA Index is August 14, 2023. The Launch Date of the S&P 500® Daily Risk Control 10% Index is May 13, 2009. The Launch Date of the Fidelity AIM® Dividend Index is July 31, 2019. All information for an index prior to its Launch Date is hypothetical back-tested, not actual performance, based on the index methodology in effect on the Launch Date.

About this tool - definitions and methodology

About this tool - definitions and methodology

Understanding the Indexed Account Analyzer

The Indexed Account Analyzer ("the analyzer") is an educational tool intended to help you understand how differing assumptions may affect the potential for interest credits from hypothetical Indexed Accounts. The calculator does not represent actual performance of a specific product or indexed account (as no product charges/fees are reflected), predict or guarantee actual or future results.

This analyzer uses the historical returns for the S&P 500® Index, S&P 500® Dynamic Intraday TCA Index, S&P 500® Daily Risk Control 10% Excess Return Index, and Fidelity AIM® Dividend Index. It uses your selected assumptions for account allocation, growth caps, participation rates, multipliers and multiplier charge (if chosen) using 0% floors and displays the hypothetical results.

How To Use This Analyzer

The user can create two “Allocations/Model” of hypothetical “Indexed Accounts” to compare different scenarios. The user inputs each Allocation by designating a weight to each Indexed Account. For each Indexed Account chosen, the user can also input rates for Cap, Participation, Fixed Bonus, 2% Multiplier and 4% Multiplier. The user may also choose a Multiplier Rider Charge level of 0%, 2%, or 4%. Choosing a charge level of 0% will mean no multiplier is applied, whereas the 2% and 4% charge levels will apply the 2% Multiplier and 4% Multiplier, respectively, to all 1 Year accounts in the Allocation. The “Inputs” tab contains additional options to further customize the results. By default, the analyzer will generate results starting with the "Earliest Start Year", which is determined based on the availability of performance data for selected indexes, starting in 1974 for the S&P 500® index. The user can alternatively input a “Custom Start Year” to begin generating returns in a later year.

The user can specify how they want the hypothetical Indexed Account returns to be calculated. The user may input a “Holding Period" which is the period over which Indexed Account returns will be compounded before calculating an annualized return. For example, if an Allocation is using 1-year Indexed Accounts, a 10-Year Holding Period would compound the return of ten consecutive indexed segments, before annualizing back the result; for a segment starting on 1/15/2000, this would calculate the annualized return of that Allocation from 1/15/2000 to 1/15/2010. Note: If 2-year Indexed Accounts are selected, the Holding Period must be an even number (2,4,6,8,10). The Holding Period simulates money rolling over in an Indexed Account for several years. Historically, the longer the period, the smoother the returns.

The user can also input the desired “Segment Month”, which is the month over which returns will be calculated. The user also has the option to choose “Average All”, which calculates the annualized return over the Holding Period starting in each of the 12 months and reports the average of those 12 returns.

Results will be calculated in the “Results” tab when the user selects the ‘View my results’ button.

All segments are assumed to start and end on the 15th of the month.

Assumptions

Returns for a given Allocation are determined by applying the Assumptions for Indexed Accounts below.

| Term |

Definition |

Value |

| Floor: |

The minimum interest credited to an Indexed Account segment |

0.00% |

| Participation: |

The adjustment to the Index return before applying the Cap or Floor |

Input by user |

| Cap: |

The maximum interest credited to an Indexed Account segment, before applying bonuses |

Input by user |

| Multiplier: |

The Indexed Bonus applied to each segment return |

Input by user |

| Fixed Bonus: |

The bonus added on top of the Indexed Credits. The Fixed Bonus does not receive the Multiplier bonus. |

Input by user |

| Allocation %: |

Percentage of total funds allocated to each Indexed Account |

Input by user |

Allowable ranges for inputted values by Indexed Account

The example below illustrates how the Net Credited Rate for one segment of an Indexed Account is calculated. It considers a single segment in the S&P500 Dynamic Intraday Fixed Bonus account (assuming a 12.75% Cap, 100% Participation, 0% Floor, 0.75% Fixed Bonus) with a Multiplier of 45% and 2.00% charge.

| Segment End |

Index Return |

Cap, Floor & Participation Rate* |

Multiplier |

Asset Based Charge |

Fixed Bonus |

Net Credited Rate** |

| 12/15/2023 |

16.10% |

12.75% |

45% |

2.00% |

0.75% |

17.24% |

| |

A |

B |

C |

D |

E |

(Bx(1+C))-D+E |

*B = Max(Min(Cap, A * Participation), Floor)

**Policy and account charges remain in effect and will reduce Policy Value.

Results

For each Allocation, the “Hypothetical Results” table displays the Indexed Account(s) Average Annualized Return for all periods over the chosen holding period and date range. Each period's annualized rate is weighted according to the chosen allocation percentages.