Welcome new employees of Prince William County Schools!

Use this checklist to help you get started with your retirement planning and review the plan highlights for an overview of the plan.

Overwhelmed by student loan debt?

Prince William County Schools offers student debt solutions through Candidly. Find out more here and register to get started at pwcs.getcandidly.com .

Interested in lifetime income?

Click here to review key features of the guaranteed retirement income option. Money that lasts for life.

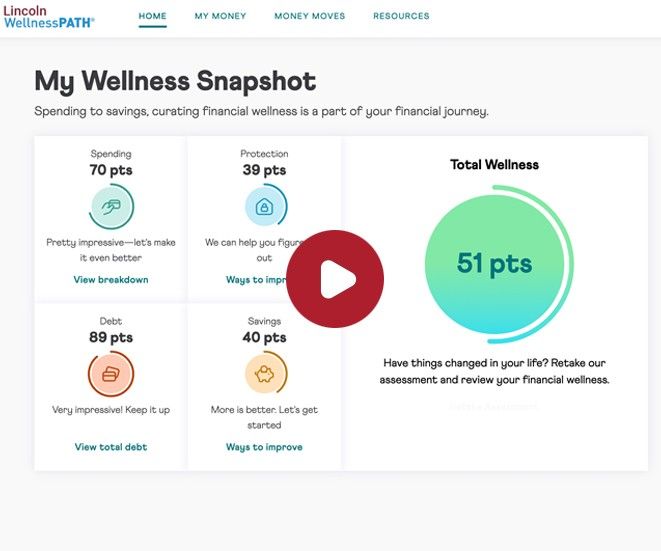

Meet Lincoln WellnessPATH®

Lincoln WellnessPATH®, accessed from your retirement plan account, helps you manage your financial life. From creating a budget to building an emergency fund to paying down debt, it's an easy-to-use online tool. Log in and try it today!

Did you know that only 21% of American workers feel very confident about their ability to afford a comfortable retirement?1

It's time to boost your retirement confidence!

Saving in your employer-sponsored retirement plan is one of the easiest ways to start planning for the retirement you imagine. So, don't wait to participate! Take advantage of this opportunity today.

Your Prince William County Schools 403(b) and 457(b) retirement plans are a part of your total compensation package. If put to good use, your plan(s) can become some of your most important workplace benefits. When you participate, you can reduce your taxable income today, while building retirement savings for tomorrow.

Learn more about your workplace retirement plan.

1Employee Benefit Research Institute and Greenwald Retirement Confidence Survey, April 2024.

Helpful information for all PWCS employees not yet participating in the PWCS Supplement plan.

-

Checklist

A short list of items you can tackle to enroll, register, and make the most of the plan - Find the retirement consultant or financial professional assigned to your location

- Virginia Retirement System

- Lincoln Financial App

- Risk Assessment Questionnaire

- PWCS Supplemental Retirement Plan Comparison Chart