Downside protection. Upside potential.

Protection from loss is important, but so is staying positioned for growth. That’s why Lincoln RIA Class annuities offer a solution linked to market growth with built-in protection.

Market-linked growth opportunities for clients more sensitive to risk

Lincoln Level Advantage® Advisory indexed variable annuityAdvisor case study: Addressing sequence of returns risk and inflation

As clients near retirement, it’s important to help them protect what they’ve worked so hard to save. But how do you also help them stay invested for growth potential so they can retire when and how they want?

Greg's challenge

For his clients approaching retirement, Greg wants to keep them invested while also reducing some downside risk. He is looking for a flexible solution he can customize to each client’s timeframe and risk tolerance. Greg would also appreciate a solution that integrates with his reporting and planning software to deliver the holistic experience his clients expect.

The solution

Greg helps his clients feel more confident staying invested through market ups and downs by allocating a portion of their portfolio to a Lincoln Level Advantage® Advisory indexed variable annuity because it delivers:

- A menu of growth strategies linked to well-known market indices

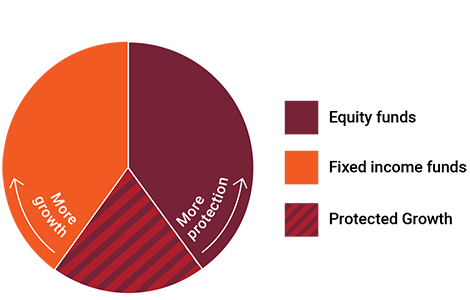

- Ability to set the level of protection based on each client’s needs

- No explicit product charges on money invested in indexed accounts

- Seamless digital experience

- No surrender charges

Get started

Connect with us and let your dedicated consultant make it easy for you to implement Lincoln RIA Class annuities.

Annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Lincoln Level Advantage® indexed variable annuity is a long-term investment product designed for retirement purposes. There are no explicit fees associated with the indexed-linked account options available. There are associated fees with the variable annuity subaccounts, which include a product charge, and administrative fees. Annuities are subject to market risk including loss of principal. Withdrawals are subject to ordinary income tax treatment and, if taken prior to age 59½ in nonqualified contracts, may be subject to an additional 10% federal tax.

Indexed-linked variable annuity products are complex insurance and investment vehicles. Please reference the prospectus for information about the levels of protection available and other important product information.

Any distribution or transfer from an indexed account (other than on the term end date) is based on the interim value of each indexed segment. This value is based on a formula and may not correspond to the current performance of the index you selected. Any distribution or transfer during a term will have a negative impact on the value at the end of the term. This reduction could be larger than the dollar amount of the distribution or transfer. See prospectus for details.

The risk of loss occurs each time you move into a new indexed account after the end of an indexed term. The protection level option selected in the indexed account helps protect you from some downside risk. If the negative return is in excess of the protection level selected, there is a risk of loss of principal. Protection levels that vary based on the index and term selected are subject to change and may not be available with every option. Please see the prospectus for details.

Investors are advised to consider the investment objectives, risks, and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable prospectuses for the variable annuity and its underlying investment options contain this and other important information. Please call 877-533-5630 for free prospectuses. Read them carefully before investing or sending money. Products and features are subject to state availability.

Lincoln Level Advantage® indexed variable annuities (contract form 30070-A 8/03 and state variations*) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All contract and rider guarantees, including those for optional benefits, payment from the indexed accounts, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by any entity other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

This product and the components and features contained within are not available in all states or firms. Please reach out to your registered representative for more details on state approvals and firm guidelines.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

*Contract form 30070-A-ID 8/03 in Idaho.

Not available in New York.

Lincoln products are not a deposit nor FDIC-insured, may go down in value, and are not insured by a federal government agency or guaranteed by any bank or savings association. All guarantees and benefits of the insurance policy are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer and/or insurance agency selling the policy, or any affiliates of those entities other than the issuing company affiliates, and none makes any representation or guarantees regarding the claims-paying ability of the issuer.