Wealth transfer strategies with tax advantages

For clients focused on leaving a legacy – but not a heavy tax burden, Lincoln RIA Class annuities can be an effective tool for managing and distributing wealth.

Tax-smart estate protection

Earnings Optimizer Death BenefitHighest Anniversary Death Benefit

Lincoln ProtectPay with Estate LockSM

Advisor case study: Tax-efficient legacy planning

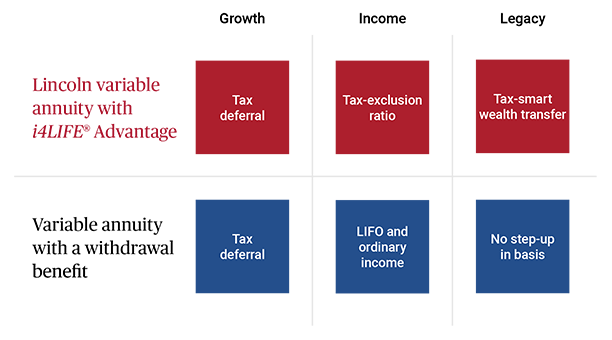

Every client invests for a reason. Maybe it’s to save for the future, to pay for a lifestyle, the desire to leave a legacy – or all the above. If you could deliver tax advantages in each situation, would you?

Caroline's challenge

She wants to give her clients the added comfort of knowing that the legacy they leave will be as streamlined and tax-efficient as possible.

The solution

Caroline establishes a tax-smart wealth transfer strategy for her clients using Lincoln RIA Class variable annuities with i4LIFE® Advantage1 because it:

- Distributes tax-efficient lifetime income when investing nonqualified money

- Simplifies the distribution of wealth

- Minimizes the impact of taxes

Get started

Connect with us and let your dedicated consultant make it easy for you to implement Lincoln RIA Class annuities.

Annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal.

1i4LIFE® Advantage is available for an additional charge of 0.40% above standard contract expenses. There is a credit to clients who select a minimum Access Period of the greater of 20 years or until age 85 — with a $500,000 deposit the credit is 0.10% annually and with a $1,000,000 deposit the credit is 0.20% annually (see prospectus for complete details).

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Please consult your own independent financial professional as to any tax, accounting or legal statements made herein.

Variable annuities are long-term investment products designed for retirement purposes and are subject to market fluctuation, investment risk, and possible loss of principal. Variable annuities contain both investment and insurance components and have fees and charges, including mortality and expense, administrative, and advisory fees. Optional features are available for an additional charge. The annuity's value fluctuates with the market value of the underlying investment options, and all assets accumulate tax-deferred. Withdrawals of earnings are taxable as ordinary income and, if taken prior to age 59½, may be subject to an additional 10% federal tax. Withdrawals will reduce the death benefit and cash surrender value.

Investors are advised to consider the investment objectives, risks and charges and expenses of the variable annuity and its underlying investment options carefully before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment options. Please call 877-533-5630 for a free prospectus. Read it carefully before investing or sending money.

Lincoln variable annuities and American Legacy® variable annuities are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer. The Lincoln National Life Insurance Company does not solicit business in the sate of New York, nor is it authorized to do so.

All contract and rider guarantees, including those for optional benefits, fixed subaccount crediting rates or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by any entity other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

They are not backed by any entity other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

Not available in New York.