- Lincoln Level Advantage 2 Income

- Lincoln Level Advantage 2

Create protected lifetime income in addition to protected growth.

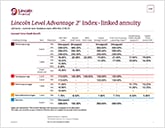

Secure lifetime income with protected payments that are guaranteed for life. And for each year you wait, your protected annual income rate increases

Safeguard your investment with levels of protection on any of the flexible investment options you choose. All options are available – even while taking income – for no explicit cost

Capture gains and reset protection as often as once a year before income starts with Secure Lock+®

Spend less on fees with low cost1 so you can keep more money working toward your goals

Protect your beneficiaries with Estate LockSM, which guarantees you leave your full investment amount with no reduction as you take lifetime income

Capture performance and reset protection.

Lincoln Level Advantage 2® index-linked annuity

Balance protection and growth as you build your wealth.

Stay invested for tax-deferred growth potential with a range of options to track market performance – including distinct strategies as well as traditional index options

Reduce risk with levels of protection to help guard against downturns

Capture gains and reset protection as often as once a year with Secure Lock+®

Pay less with no explicit costs so you can save more of what you earn

Capture performance and reset protection.

Get started

Connect with us and let your dedicated consultant make it easy for you to implement Lincoln RIA Class annuities.

1Morningstar. As compared to a traditional variable annuity with an income rider.

This material is authorized for use only when preceded or accompanied by a prospectus, which describes investment objectives, risk factors, fees and charges that may apply as well as other important information. Please read the prospectus carefully before you invest or send money. The prospectus can be obtained by calling 877-533-5630.

Lincoln Financial® affiliates, their distributors, and their respective employees, representatives and/or insurance agents do not provide tax, accounting or legal advice. Please consult an independent professional as to any tax, accounting or legal statements made herein.

Important information:

Lincoln Level Advantage 2® index-linked annuity is a long-term investment product designed for retirement purposes. There are no explicit fees associated with the index-linked account options available. Annuities are subject to market risk including loss of principal. Withdrawals are subject to ordinary income tax treatment and, if taken prior to age 59½ in nonqualified contracts, may be subject to an additional 10% federal tax.

Index-linked products are complex insurance and investment vehicles. Please reference the prospectus for information about the levels of protection available and other important product information.

Any distribution or transfer from an indexed account (other than on the term end date) is based on the interim value of each indexed segment. This value is based on a formula and may not correspond to the current performance of the index you selected. Any distribution or transfer during a term will have a negative impact on the value at the end of the term. This reduction could be larger than the dollar amount of the distribution or transfer. See prospectus for details.

The risk of loss occurs each time you move into a new indexed account. If the negative return is in excess of the protection level selected, there is a risk of loss of principal. Protection levels that vary based on the index, term, and crediting strategy selected are subject to change and may not be available with every option. Please see the prospectus for details.

The Lincoln Level Advantage 2® index-linked annuity suite (contract forms 24-50091, 25-50097, ICC25-50097, and state variations) are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, and distributed by Lincoln Financial Distributors, Inc., a broker-dealer The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so.

All contract and rider guarantees, including those for optional benefits, payment from the indexed accounts, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by any selling entity other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

This product and the components and features contained within are not available in all states or firms.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

Not available in New York.