Why long-term disability (LTD) insurance?LTD can help protect you and your loved ones financially if you're unable to work for an extended time due to sickness, injury or surgery. |

|

How does it work? LTD insurance replaces a portion of your income if you're unable to work for longer than a specified number of days (see plan details). When you elect this coverage, you receive a monthly payment to replace some of the income you would earn if you were working. |

|

When do payments start? Use sick leave or paid time off to first cover the elimination period — a set time frame based on your policy. After that, you receive a portion of your weekly salary as a cash benefit to help ease the financial burden while you’re away from work. |

Get the protection you need

-

Long-term disability insurance -

Short-term disability insurance -

Life insurance -

Benefit Summaries -

Contact us

Why short-term disability (STD) insurance?STD insurance can help financially protect you and your loved ones if you're unable to work due to sickness, injury, surgery or recovery from childbirth. |

|

How does it work? STD insurance replaces a portion of your income if you’re unable to work for a short period (see plan details). When you elect this coverage, you receive a monthly payment to replace some of the income you would earn if you were working. |

|

When do payments start? Use sick leave or paid time off to first cover the elimination period — a set time frame based on your policy. After that, you receive a portion of your weekly salary as a cash benefit to help ease the financial burden while you’re away from work. |

Why life insurance?Life insurance can help secure your family’s financial future. This affordable coverage provides a cash benefit for your beneficiaries when they need it most. |

|

What can the money be used for? Use it for anything — such as everyday expenses, final expenses or retirement and savings funds — to ease your family’s financial burdens. |

|

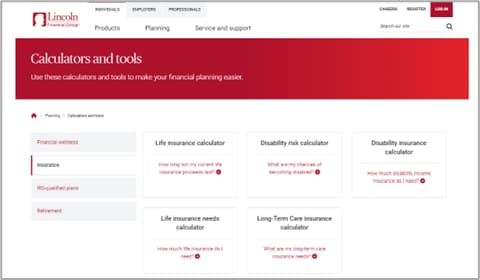

Decide which level of coverage is right for you. If this is your first time purchasing life insurance, finding the plan that fits your needs can seem daunting. We offer easy-to-use tools to guide you in the right direction so you can enroll with confidence. |

VIDEOS

RESOURCES

Benefit Summaries |

Contact us

Lincoln Financial Customer Service Center 800-423-2765

|