In March 2023, we took the pulse of workers and saw the effects of a turbulent 2022. Inflation, market fluctuations and economic uncertainty had a cumulative effect on employee confidence and behavior.

Our 2023 Wellness@Work survey shows that after a tough year, retirement contributions are down. But there’s good news — we also discovered top motivators to get employees to save more.

The top three saving motivators:

Having a clearer vision of the retirement I could afford if I increased contributions

Feeling more confident about saving and investing decisions

Having a road map for how to reduce my debt

We’ll share resources based on what we learned to help you optimize plan design and educate employees so they can make informed decisions and take positive actions.

The study is based on a national survey of 2,604

full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Unless otherwise noted, all information provided on this website is from the 2023 Wellness@Work Study.

Encourage your participants to adopt the top three habits of successful savers.

68% of participants

are saving less than they think they need to save to be on track for retirement

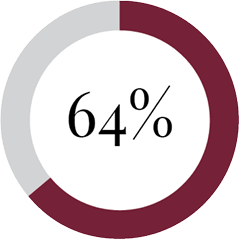

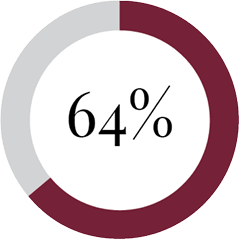

64% of non-participants

want to start contributing, but only 27% have made a plan to do so

How do your employees feel?

See 2023 Wellness@Work Study results broken down by industry:

See how helping your employees choose the right benefits can support retirement goals.

Our research shows how debt, medical expenses and student loans can all derail retirement savings. Holistic well-being solutions such as disability, critical illness and accident insurance, and health savings accounts (HSAs), can help employees manage more easily. Providing education so employees can choose the right benefits may help them stay on track.

Online resources aligned with saving motivators may help drive deferral rate increases.

The participant web experience makes it fast and easy for employees to see where they stand and take action.

Lincoln WellnessPATH® is a personalized financial wellness tool that helps participants manage their financial lives. They can track progress toward goals, make a budget and receive custom action steps to help improve their financial wellness.

Retirement saving education gives employees the knowledge they’re looking for.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

In March 2023, we took the pulse of workers and saw the effects of a turbulent 2022. Inflation, market fluctuations and economic uncertainty had a cumulative effect on employee confidence and behavior.

Our 2023 Wellness@Work survey shows that after a tough year, retirement contributions are down. But there’s good news — we also discovered top motivators to get employees to save more.

The top three saving motivators:

Having a clearer vision of the retirement I could afford if I increased contributions

Feeling more confident about saving and investing decisions

Having a road map for how to reduce my debt

We’ll share resources based on what we learned to help you optimize plan design and educate employees so they can make informed decisions and take positive actions.

The study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Unless otherwise noted, all information provided on this website is from the 2023 Wellness@Work Study.

Encourage your participants to adopt the top three habits of successful savers.

68% of participants

are saving less than they think they need to save to be on track for retirement

64% of non-participants

want to start contributing, but only 27% have made a plan to do so

How do your employees feel?

See 2023 Wellness@Work Study results broken down by industry:

Our research shows how debt, medical expenses and student loans can all derail retirement savings. Holistic well-being solutions such as disability, critical illness and accident insurance, and health savings accounts (HSAs), can help employees manage more easily. Providing education so employees can choose the right benefits may help them stay on track.

See how helping your employees choose the right benefits can support retirement goals.

Online resources aligned with saving motivators may help drive deferral rate increases.

The participant web experience makes it fast and easy for employees to see where they stand and take action.

Lincoln WellnessPATH® is a personalized financial wellness tool that helps participants manage their financial lives. They can track progress toward goals, make a budget and receive custom action steps to help improve their financial wellness.

Retirement saving education gives employees the knowledge they’re looking for.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

In March 2023, we took the pulse of workers and saw the effects of a turbulent 2022. Inflation, market fluctuations and economic uncertainty had a cumulative effect on employee confidence and behavior.

Our 2023 Wellness@Work survey shows that after a tough year, retirement contributions are down. But there’s good news — we also discovered top motivators to get employees to save more.

The top three saving motivators:

Having a clearer vision of the retirement I could afford if I increased contributions

Feeling more confident about saving and investing decisions

Having a road map for how to reduce my debt

We’ll share resources based on what we learned to help you optimize plan design and educate employees so they can make informed decisions and take positive actions.

The study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Unless otherwise noted, all information provided on this website is from the 2023 Wellness@Work Study.

Encourage your participants to adopt the top three habits of successful savers.

68% of participants

are saving less than they think they need to save to be on track for retirement

64% of non-participants

want to start contributing, but only 27% have made a plan to do so

How do your employees feel?

See 2023 Wellness@Work Study results broken down by industry:

Our research shows how debt, medical expenses and student loans can all derail retirement savings. Holistic well-being solutions such as disability, critical illness and accident insurance, and health savings accounts (HSAs), can help employees manage more easily. Providing education so employees can choose the right benefits may help them stay on track.

See how helping your employees choose the right benefits can support retirement goals.

Online resources aligned with saving motivators may help drive deferral rate increases.

The participant web experience makes it fast and easy for employees to see where they stand and take action.

Lincoln WellnessPATH® is a personalized financial wellness tool that helps participants manage their financial lives. They can track progress toward goals, make a budget and receive custom action steps to help improve their financial wellness.

Retirement saving education gives employees the knowledge they’re looking for.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

In March 2023, we took the pulse of workers and saw the effects of a turbulent 2022. Inflation, market fluctuations and economic uncertainty had a cumulative effect on employee confidence and behavior.

Our 2023 Wellness@Work survey shows that after a tough year, retirement contributions are down. But there’s good news — we also discovered top motivators to get employees to save more.

The top three saving motivators:

Having a clearer vision of the retirement I could afford if I increased contributions

Feeling more confident about saving and investing decisions

Having a road map for how to reduce my debt

We’ll share resources based on what we learned to help you optimize plan design and educate employees so they can make informed decisions and take positive actions.

The study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Unless otherwise noted, all information provided on this website is from the 2023 Wellness@Work Study.

Encourage your participants to adopt the top three habits of successful savers.

68% of participants

are saving less than they think they need to save to be on track for retirement

64% of non-participants

want to start contributing, but only 27% have made a plan to do so

See how helping your employees choose the right benefits can support retirement goals.

Our research shows how debt, medical expenses and student loans can all derail retirement savings. Holistic well-being solutions such as disability, critical illness and accident insurance, and health savings accounts (HSAs), can help employees manage more easily. Providing education so employees can choose the right benefits may help them stay on track.

Online resources aligned with saving motivators may help drive deferral rate increases.

The participant web experience makes it fast and easy for employees to see where they stand and take action.

Lincoln WellnessPATH® is a personalized financial wellness tool that helps participants manage their financial lives. They can track progress toward goals, make a budget and receive custom action steps to help improve their financial wellness.

Retirement saving education gives employees the knowledge they’re looking for.

Read the full report to explore the 2023 research and solutions.

Wellness@Work is a platform for research and viewpoints on central issues related to group benefits and retirement planning. The program seeks to identify forward-thinking ways to help financial professionals, employers and employees. As part of the program, Lincoln sponsors both proprietary and third party research, with an emphasis on what drives better benefit and retirement outcomes.

The 2023 Wellness@Work study is based on a national survey of 2,604 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,104 participants and 500 non-participants. Greenwald & Associates, a third party market research firm, conducted the study on behalf of Lincoln Retirement Plan Services. Greenwald & Associates is not associated with Lincoln Financial Group. Online interviewing took place from February 16 to March 14, 2023. Data is weighted by demographics to mirror the total population.

The 2022 Wellness@Work study is based on a national survey of 2,503 full-time workers who have access to insurance benefits (at least one of the following: disability, life, dental, vision, critical illness, accident or hospital indemnity) through their employer. Greenwald Research, a third-party market research firm, conducted the study on behalf of Lincoln Financial Group. Greenwald Research is not associated with Lincoln Financial Group. Online interviewing took place from January 28, 2022 to March 1, 2022. Data is weighted by demographics to mirror the total population.

Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and contractual obligations.

Privacy | Legal | ©2023 Lincoln National Corporation

LCN-6085650-110823

12/23 Z03

Order code: GP-GPMR-IDE001

How do your employees feel?

See 2023 Wellness@Work Study results broken down by industry: