Many employees are offered benefits they don’t use. Nearly 30% say they should be enrolled in more. Why?

Lack of awareness

Unclear value

Lack of clarity around offerings

Closing these knowledge gaps—especially during annual enrollment—can help boost confidence, increase adoption, and improve how benefits are valued.

Many employees aren’t familiar with their benefits, making it harder to choose what’s right for them. This lack of understanding can lead to missed opportunities like not enrolling in programs that support financial wellness or choosing options that don’t fit their needs.

Filter by group to compare.

Very familiar with their available benefits

Understand purpose and use of each benefit

Know which benefits fit their needs

All workers

Workers in construction

Employees who understand their benefits are more likely to enroll — and see value in them.

56%

of workers who are very familiar with their benefits say they get a lot of value from them

Choose the spending amount circle to see how the cost of benefits shapes their perceived value.

Spend a little

Get little value

Get some value

Get a lot of value

A robust benefits package with wellness solutions or voluntary benefits, such as accident, critical illness and hospital indemnity insurance, can help cover expenses when the unexpected occurs. But many who face these bills aren’t enrolled in the benefits that could help most.value in them.

A complicated pregnancy and the premature birth of her twins led to weeks in the neonatal intensive care unit and overwhelming medical bills. Even with health insurance, Jessica’s family was left deep in debt.

Lincoln Financial paid Jessica for the use of her story.

Many employees face significant medical costs—but few are enrolled in the benefits that could help. This gap suggests missed opportunities to reduce out-of-pocket expenses and improve financial resilience.

Select each tab to view data for employees at organizations of different sizes (based on employee count).

Workers at employers with fewer than 100 employees

paid major or moderate medical bills in recent years

enrolled in accident insurance

enrolled in critical illness insurance

enrolled in hospital indemnity insurance

Fewer than 100

Only half (52%) of workers feel very confident their benefits can protect them from unexpected expenses. That’s a missed opportunity because when employees understand their benefits, they’re far more likely to enroll and feel secure in their choices.

Personal support makes a difference. In fact, employees who connect with a financial professional are twice as confident in their decisions. The good news? They’re open to help:

Get the whole story

Benefits done well can help transform employee confidence, loyalty and retirement readiness. See what’s possible — download the full Wellness@Work white paper.

The 2025 Wellness@Work Study is based on a national survey of 2,509 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,004 participants and 505 non-participants. Greenwald Research, a third party market research firm, conducted the study on behalf of Lincoln Financial. The 19-minute online survey took place from January 31 to March 4, 2025. Data is weighted by demographics to reflect the total population.

Insurance products are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, which does not solicit business in New York, nor is it licensed to do so. In New York, insurance products are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY. Both are Lincoln Financial companies. Product availability and/or features may vary by state. Limitations and exclusions apply.

Guaranteed income solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses, including administrative and advisory fees. The annuity’s value fluctuates with the market value of the underlying investment option, and all assets accumulate tax-deferred. Withdrawals may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment option. Please call 800-234-3500 for a prospectus. Carefully read it before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln Financial (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. Affiliates are separately responsible for their own financial and contractual obligations.

No insurance purchase is necessary to use the WellnessPATH® Marketplace.

Lincoln is not affiliated with third party vendors provided through the WellnessPATH® Marketplace.

Lincoln may receive a marketing distribution fee for third party products purchased through WellnessPATH® Marketplace. Depending on the arrangement, it may be a flat-dollar fee or a percentage of fees received by the third party vendor ranging from $1 – $600 per purchase transaction.

Lincoln and its affiliates do not provide advice about the products and services offered by third parties. The information provided through WellnessPATH® Marketplace is general and educational in nature and should not be considered professional advice. Everyone’s circumstances are different and before making a financial wellness decision, an appropriate professional should be consulted.

WellnessPATH® Marketplace may offer links to third party websites that are not part of Lincoln’s websites (“Sites”). Lincoln does not own, control, or endorse the content or products and services available through these third party websites. Lincoln does not assume any responsibility for any losses or damages in connection with the security, privacy practices, or content of any third party websites. These third party websites may have privacy and security policies that differ from our Sites.

Privacy | Legal | © 2025 Lincoln National Corporation

9/25 Z01

Order code: WPS-WAWDE-IDE001

LCN-8175851-071525

Many employees are offered benefits they don’t use. Nearly 30% say they should be enrolled in more. Why?

Lack of awareness

Unclear value

Lack of clarity around offerings

Closing these knowledge gaps—especially during annual enrollment—can help boost confidence, increase adoption, and improve how benefits are valued.

Many employees aren’t familiar with their benefits, making it harder to choose what’s right for them. This lack of understanding can lead to missed opportunities like not enrolling in programs that support financial wellness or choosing options that don’t fit their needs.

Filter by group to compare.

Very familiar with their available benefits

Understand purpose and use of each benefit

Know which benefits fit their needs

All workers

Workers in construction

Employees who understand their benefits are more likely to enroll — and see value in them.

56%

of workers who are very familiar with their benefits say they get a lot of value from them

Choose the spending amount circle to see how the cost of benefits shapes their perceived value.

Spend a little

Get little value

Get some value

Get a lot of value

A robust benefits package with wellness solutions or voluntary benefits, such as accident, critical illness and hospital indemnity insurance, can help cover expenses when the unexpected occurs. But many who face these bills aren’t enrolled in the benefits that could help most.value in them.

A complicated pregnancy and the premature birth of her twins led to weeks in the neonatal intensive care unit and overwhelming medical bills. Even with health insurance, Jessica’s family was left deep in debt.

Lincoln Financial paid Jessica for the use of her story.

Many employees face significant medical costs—but few are enrolled in the benefits that could help. This gap suggests missed opportunities to reduce out-of-pocket expenses and improve financial resilience.

Select each tab to view data for employees at organizations of different sizes (based on employee count).

Workers at employers with fewer than 100 employees

paid major or moderate medical bills in recent years

enrolled in accident insurance

enrolled in critical illness insurance

enrolled in hospital indemnity insurance

Fewer than 100

Only half (52%) of workers feel very confident their benefits can protect them from unexpected expenses. That’s a missed opportunity because when employees understand their benefits, they’re far more likely to enroll and feel secure in their choices.

Personal support makes a difference. In fact, employees who connect with a financial professional are twice as confident in their decisions. The good news? They’re open to help:

Get the whole story

Benefits done well can help transform employee confidence, loyalty and retirement readiness. See what’s possible — download the full Wellness@Work white paper.

The 2025 Wellness@Work Study is based on a national survey of 2,509 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,004 participants and 505 non-participants. Greenwald Research, a third party market research firm, conducted the study on behalf of Lincoln Financial. The 19-minute online survey took place from January 31 to March 4, 2025. Data is weighted by demographics to reflect the total population.

Insurance products are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, which does not solicit business in New York, nor is it licensed to do so. In New York, insurance products are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY. Both are Lincoln Financial companies. Product availability and/or features may vary by state. Limitations and exclusions apply.

Guaranteed income solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses, including administrative and advisory fees. The annuity’s value fluctuates with the market value of the underlying investment option, and all assets accumulate tax-deferred. Withdrawals may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment option. Please call 800-234-3500 for a prospectus. Carefully read it before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln Financial (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. Affiliates are separately responsible for their own financial and contractual obligations.

No insurance purchase is necessary to use the WellnessPATH® Marketplace.

Lincoln is not affiliated with third party vendors provided through the WellnessPATH® Marketplace.

Lincoln may receive a marketing distribution fee for third party products purchased through WellnessPATH® Marketplace. Depending on the arrangement, it may be a flat-dollar fee or a percentage of fees received by the third party vendor ranging from $1 – $600 per purchase transaction.

Lincoln and its affiliates do not provide advice about the products and services offered by third parties. The information provided through WellnessPATH® Marketplace is general and educational in nature and should not be considered professional advice. Everyone’s circumstances are different and before making a financial wellness decision, an appropriate professional should be consulted.

WellnessPATH® Marketplace may offer links to third party websites that are not part of Lincoln’s websites (“Sites”). Lincoln does not own, control, or endorse the content or products and services available through these third party websites. Lincoln does not assume any responsibility for any losses or damages in connection with the security, privacy practices, or content of any third party websites. These third party websites may have privacy and security policies that differ from our Sites.

Privacy | Legal | © 2025 Lincoln National Corporation

9/25 Z01

Order code: WPS-WAWDE-IDE001

LCN-8175851-071525

Many employees are offered benefits they don’t use. Nearly 30% say they should be enrolled in more. Why?

Lack of awareness

Unclear value

Lack of clarity around offerings

Closing these knowledge gaps—especially during annual enrollment—can help boost confidence, increase adoption, and improve how benefits are valued.

Many employees aren’t familiar with their benefits, making it harder to choose what’s right for them. This lack of understanding can lead to missed opportunities like not enrolling in programs that support financial wellness or choosing options that don’t fit their needs.

Filter by group to compare.

Very familiar with their available benefits

Understand purpose and use of each benefit

Know which benefits fit their needs

All workers

Workers in construction

Employees who understand their benefits are more likely to enroll — and see value in them.

56%

of workers who are very familiar with their benefits say they get a lot of value from them

Choose the spending amount circle to see how the cost of benefits shapes their perceived value.

Spend a little

Get little value

Get some value

Get a lot of value

A robust benefits package with wellness solutions or voluntary benefits, such as accident, critical illness and hospital indemnity insurance, can help cover expenses when the unexpected occurs. But many who face these bills aren’t enrolled in the benefits that could help most.value in them.

A complicated pregnancy and the premature birth of her twins led to weeks in the neonatal intensive care unit and overwhelming medical bills. Even with health insurance, Jessica’s family was left deep in debt.

Lincoln Financial paid Jessica for the use of her story.

Many employees face significant medical costs—but few are enrolled in the benefits that could help. This gap suggests missed opportunities to reduce out-of-pocket expenses and improve financial resilience.

Select each tab to view data for employees at organizations of different sizes (based on employee count).

Workers at employers with fewer than 100 employees

paid major or moderate medical bills in recent years

enrolled in accident insurance

enrolled in critical illness insurance

enrolled in hospital indemnity insurance

Fewer than 100

Only half (52%) of workers feel very confident their benefits can protect them from unexpected expenses. That’s a missed opportunity because when employees understand their benefits, they’re far more likely to enroll and feel secure in their choices.

Personal support makes a difference. In fact, employees who connect with a financial professional are twice as confident in their decisions. The good news? They’re open to help:

Get the whole story

Benefits done well can help transform employee confidence, loyalty and retirement readiness. See what’s possible — download the full Wellness@Work white paper.

The 2025 Wellness@Work Study is based on a national survey of 2,509 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,004 participants and 505 non-participants. Greenwald Research, a third party market research firm, conducted the study on behalf of Lincoln Financial. The 19-minute online survey took place from January 31 to March 4, 2025. Data is weighted by demographics to reflect the total population.

Insurance products are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, which does not solicit business in New York, nor is it licensed to do so. In New York, insurance products are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY. Both are Lincoln Financial companies. Product availability and/or features may vary by state. Limitations and exclusions apply.

Guaranteed income solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses, including administrative and advisory fees. The annuity’s value fluctuates with the market value of the underlying investment option, and all assets accumulate tax-deferred. Withdrawals may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment option. Please call 800-234-3500 for a prospectus. Carefully read it before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln Financial (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. Affiliates are separately responsible for their own financial and contractual obligations.

No insurance purchase is necessary to use the WellnessPATH® Marketplace.

Lincoln is not affiliated with third party vendors provided through the WellnessPATH® Marketplace.

Lincoln may receive a marketing distribution fee for third party products purchased through WellnessPATH® Marketplace. Depending on the arrangement, it may be a flat-dollar fee or a percentage of fees received by the third party vendor ranging from $1 – $600 per purchase transaction.

Lincoln and its affiliates do not provide advice about the products and services offered by third parties. The information provided through WellnessPATH® Marketplace is general and educational in nature and should not be considered professional advice. Everyone’s circumstances are different and before making a financial wellness decision, an appropriate professional should be consulted.

WellnessPATH® Marketplace may offer links to third party websites that are not part of Lincoln’s websites (“Sites”). Lincoln does not own, control, or endorse the content or products and services available through these third party websites. Lincoln does not assume any responsibility for any losses or damages in connection with the security, privacy practices, or content of any third party websites. These third party websites may have privacy and security policies that differ from our Sites.

Privacy | Legal | © 2025 Lincoln National Corporation

9/25 Z01

Order code: WPS-WAWDE-IDE001

LCN-8175851-071525

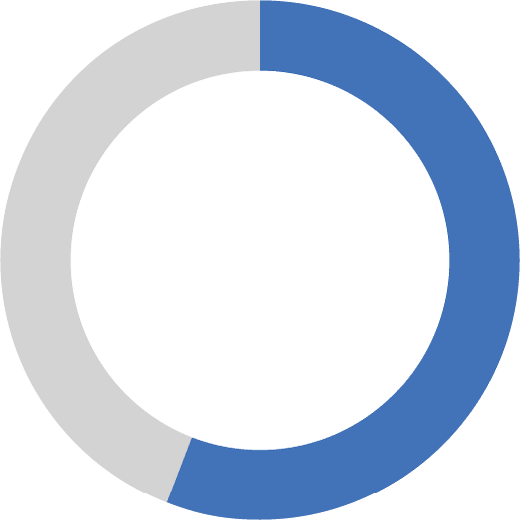

Many employees are offered benefits they don’t use. Nearly 30% say they should be enrolled in more. Why?

Lack of awareness

Unclear value

Lack of clarity around offerings

Closing these knowledge gaps—especially during annual enrollment—can help boost confidence, increase adoption, and improve how benefits are valued.

Many employees aren’t familiar with their benefits, making it harder to choose what’s right for them. This lack of understanding can lead to missed opportunities like not enrolling in programs that support financial wellness or choosing options that don’t fit their needs.

Filter by group to compare.

Very familiar with their available benefits

Understand purpose and use of each benefit

Know which benefits fit their needs

All workers

Workers in construction

Employees who understand their benefits are more likely to enroll — and see value in them.

56%

of workers who are very familiar with their benefits say they get a lot of value from them

Choose the spending amount circle to see how the cost of benefits shapes their perceived value.

Spend a little

Get little value

Get some value

Get a lot of value

A robust benefits package with wellness solutions or voluntary benefits, such as accident, critical illness and hospital indemnity insurance, can help cover expenses when the unexpected occurs. But many who face these bills aren’t enrolled in the benefits that could help most.value in them.

A complicated pregnancy and the premature birth of her twins led to weeks in the neonatal intensive care unit and overwhelming medical bills. Even with health insurance, Jessica’s family was left deep in debt.

Lincoln Financial paid Jessica for the use of her story.

Many employees face significant medical costs—but few are enrolled in the benefits that could help. This gap suggests missed opportunities to reduce out-of-pocket expenses and improve financial resilience.

Select each tab to view data for employees at organizations of different sizes (based on employee count).

Fewer than 100

Workers at employers with fewer than 100 employees

paid major or moderate medical bills in recent years

enrolled in accident insurance

enrolled in critical illness insurance

enrolled in hospital indemnity insurance

Only half (52%) of workers feel very confident their benefits can protect them from unexpected expenses. That’s a missed opportunity because when employees understand their benefits, they’re far more likely to enroll and feel secure in their choices.

Personal support makes a difference. In fact, employees who connect with a financial professional are twice as confident in their decisions. The good news? They’re open to help:

Benefits done well can help transform employee confidence, loyalty and retirement readiness. See what’s possible — download the full Wellness@Work white paper.

The 2025 Wellness@Work Study is based on a national survey of 2,509 full-time workers who are eligible to contribute to an employer-sponsored retirement plan, including 2,004 participants and 505 non-participants. Greenwald Research, a third party market research firm, conducted the study on behalf of Lincoln Financial. The 19-minute online survey took place from January 31 to March 4, 2025. Data is weighted by demographics to reflect the total population.

Insurance products are issued by The Lincoln National Life Insurance Company, Fort Wayne, IN, which does not solicit business in New York, nor is it licensed to do so. In New York, insurance products are issued by Lincoln Life & Annuity Company of New York, Syracuse, NY. Both are Lincoln Financial companies. Product availability and/or features may vary by state. Limitations and exclusions apply.

Guaranteed income solutions are offered as a group variable annuity. The guarantee is provided by a contract between the client/plan sponsor and The Lincoln National Life Insurance Company that provides a plan participant with guaranteed annual retirement income. All contract and rider guarantees, including those for optional benefits, guaranteed income, or annuity payout rates, are subject to the claims-paying ability of the issuing insurance company. They are not backed by the broker-dealer or insurance agency from which this annuity is purchased or any affiliates of those entities other than the issuing company affiliates, and none makes any representations or guarantees regarding the claims-paying ability of the issuer.

A group variable annuity is a long-term investment product designed particularly for retirement purposes and may not be suitable for all investors. Group annuities contain both investment and insurance components and have fees and expenses, including administrative and advisory fees. The annuity’s value fluctuates with the market value of the underlying investment option, and all assets accumulate tax-deferred. Withdrawals may carry tax consequences, including possible tax penalties.

The content provided herein is for informational purposes only and should not be considered investment advice or a recommendation to purchase a particular investment option.

Lincoln Financial affiliates, their affiliated distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice. Clients should consult their own independent financial professionals as to any tax, accounting, or legal statements made herein.

Investors are advised to consider carefully the investment objectives, risks, and charges and expenses of the group variable annuity and its underlying investment option before investing. The applicable variable annuity prospectus contains this and other important information about the variable annuity and its underlying investment option. Please call 800-234-3500 for a prospectus. Carefully read it before investing or sending money. Products and features are subject to state availability.

There is no additional tax-deferral benefit for an annuity contract purchased in an IRA or other tax-qualified plan.

This material is provided by The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY, and their applicable affiliates (collectively referred to as “Lincoln”). The Lincoln National Life Insurance Company does not solicit business in the state of New York, nor is it authorized to do so. Lincoln does not provide investment advice, and this material is not intended to provide investment advice. Lincoln has financial interests that are served by the sale of Lincoln programs, products, and services.

Lincoln Financial (“Lincoln”) is the marketing name for Lincoln National Corporation and its affiliates, including Lincoln Retirement Services Company, LLC, The Lincoln National Life Insurance Company, Fort Wayne, IN, and, in New York, Lincoln Life & Annuity Company of New York, Syracuse, NY. Affiliates are separately responsible for their own financial and contractual obligations.

No insurance purchase is necessary to use the WellnessPATH® Marketplace.

Lincoln is not affiliated with third party vendors provided through the WellnessPATH® Marketplace.

Lincoln may receive a marketing distribution fee for third party products purchased through WellnessPATH® Marketplace. Depending on the arrangement, it may be a flat-dollar fee or a percentage of fees received by the third party vendor ranging from $1 – $600 per purchase transaction.

Lincoln and its affiliates do not provide advice about the products and services offered by third parties. The information provided through WellnessPATH® Marketplace is general and educational in nature and should not be considered professional advice. Everyone’s circumstances are different and before making a financial wellness decision, an appropriate professional should be consulted.

WellnessPATH® Marketplace may offer links to third party websites that are not part of Lincoln’s websites (“Sites”). Lincoln does not own, control, or endorse the content or products and services available through these third party websites. Lincoln does not assume any responsibility for any losses or damages in connection with the security, privacy practices, or content of any third party websites. These third party websites may have privacy and security policies that differ from our Sites.

Privacy | Legal | © 2025 Lincoln National Corporation

9/25 Z01

Order code: WPS-WAWDE-IDE001

LCN-8175851-071525